Without going in to individual security selection, I want to touch on an idea that I’ve been formulating for a while. It first crossed my mind when Macy’s reported better than expected earnings last year and I thought it was a curious theory but then never pursued it.

Then Toys R Us declared bankruptcy. I thought back on the days when my parents took me to Toys R Us and the happiness I felt just walking the aisles even if I didn’t walk out with anything.

Then Sears filed for bankruptcy and while reading about the declaration and about what brought a once iconic American company over the edge made the idea come up once again, only this time stronger. Retail is a sector that has lagged behind the broader S&P for a while now and hasn’t really shown a promise rebounding. Amazon has taken over. Having worked for a startup that leveraged amazon’s platform, I saw first hand the dominance Amazon has in the marketplace of goods. Not only do they sell everything, they produce everything as well. From Amazon branded clothing to Amazon branded food, Amazon has gone from the little online book seller to the everything store.

But how much can their dominance grow and have traditional brick and mortar retailers felt the full effect of this? I believe so. While reading about Sears and the events that led to it’s fall, one of the major thing I noticed was the lack of spending on technology. Retail companies that have weathered the Amazon storm have a major characteristic shared among them. They invested heavily in technology over the last 5 years. It doesn’t matter if it’s Walmart’s acquisition of jet.com or Target enhancing their own online presence, brick and mortar retailers have found the secret ingredient to stay competitive and not lose any more market share to online only retailers.

Further reinforcing my theory is that online direct to consumer companies such as mattress startups Casper and Tuft & Needle have made the push in to retail stores. While these stores are limited, I believe that they have plans to expand their brick and mortar presence in an effort to give more consumers an experience and a place to test their products.

In my opinion going to a mall or store is an experience and a good reason to get out of the house. I know plenty of people that enjoy actively shopping and walking around which is, for obvious reasons, impossible to do through online stores. While my original thesis was that companies investing in technology can and ultimately will weather the storm I also believe that a push back in to traditional retail will bring back a resurgence in REIT’s that are heavily invested in shopping centers and malls.

While I am unsure about substantial growth coming in the form of new stores I would expect that same store revenue year over year will continue to increase for traditional retailers, regardless of their push into e-commerce or not. Consumer sentiment stands at 98.3 and consumer confidence is hovering around 137.9. Both of these numbers show that Americans are happy with their current financial situation and expect the good times to keep rolling. Heading in to this holiday shopping season, I would expect higher than last year spending, even with the recent volatility in the markets.

As traditional retailers adapt to e-commerce taking a larger percentage of market share I believe the focus will shift from products in the stores to getting customers in the door with the allure of an experience. Instead of investing in large stores that hold many products, giving customers an experience that will make them want to leave their house and forgo online shopping will be the key. Give me a shoe store where I can try on shoes and jump on a treadmill, show me a clothing store where I can find the best products for me and order them directly to my house. I’d rather go to a Teavana that is a cafe setting and then purchase the tea I enjoyed after casually tasting and exploring their selection.

A recent trip to a local mall showed one of our contributors how retail is changing first hand. Gone are big box stores sprawling thousands of square feet with scores of goods. They have been replaced with things like a Tesla retail store where you can purchase merchandise and sit in the most recent model. Interested buyers can be set up a test drive and learn everything they want to know about the car without leaving the mall. In another portion of the mall our contributor found a new Nespresso store which was centered more around having customers sample new flavors free of charge rather than pushing product to purchase.

With a lot of market research coming out showing that the expectation for the near term is “growing but slowing” I expect the retail sector to stay in line with that. Overall, I am long on the sector in a 5-7 year outlook and have begun the process of looking for individual companies that show the potential to not only survive the storm but come out stronger.

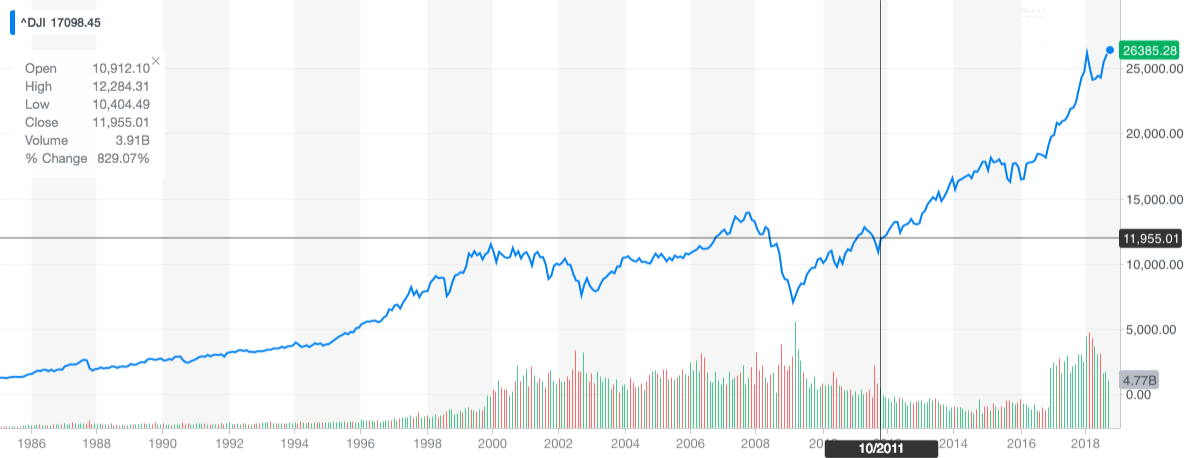

The Dow traces its roots back to 1885 and was officially introduced in 1896 when Charles Dow calculated an average of 12 purely industrial stocks. Surprisingly, it is not the oldest index as it is 12 years younger than the Dow Transportation Average. It has come a long way since then and now holds 30 stocks with none of the original 12 remaining. GE has the record for the longest Dow membership, but was recently removed for Walgreens amidst a series of financial blunders. The companies are selected by a committee of experts with the goal being to select companies that together best represent the US economy as a whole rather than purely industrials for which it was originally intended.

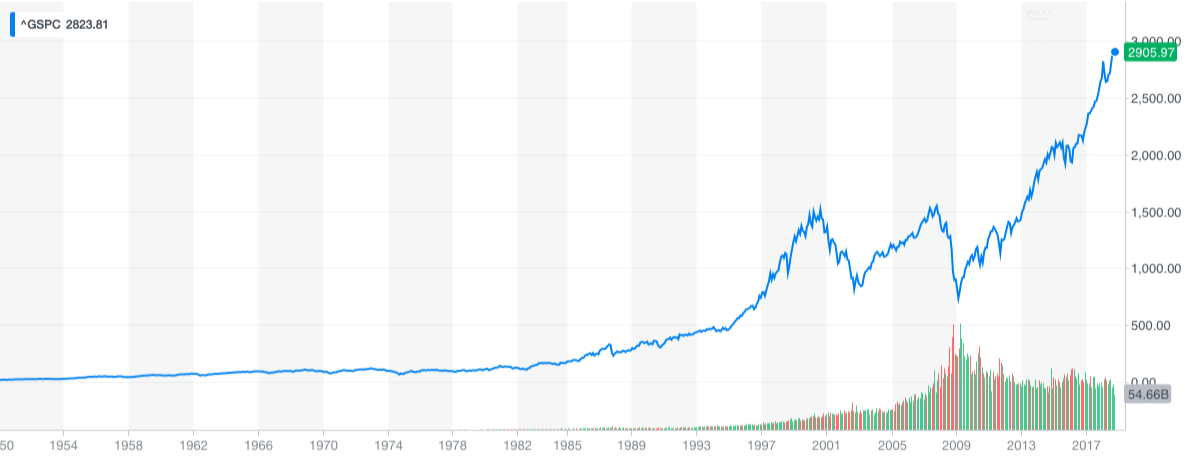

The Dow traces its roots back to 1885 and was officially introduced in 1896 when Charles Dow calculated an average of 12 purely industrial stocks. Surprisingly, it is not the oldest index as it is 12 years younger than the Dow Transportation Average. It has come a long way since then and now holds 30 stocks with none of the original 12 remaining. GE has the record for the longest Dow membership, but was recently removed for Walgreens amidst a series of financial blunders. The companies are selected by a committee of experts with the goal being to select companies that together best represent the US economy as a whole rather than purely industrials for which it was originally intended. Started in 1957, the S&P 500 is a weighted average of the top 500 stocks in the US by market cap. Unlike the price weight of the Dow the S&P 500 is cap weighted meaning that companies with a larger market capitalization represent a larger portion of the index. For example, a price swing in Amazon would have a bigger effect on the index than a price swing in Campbell’s Soup.

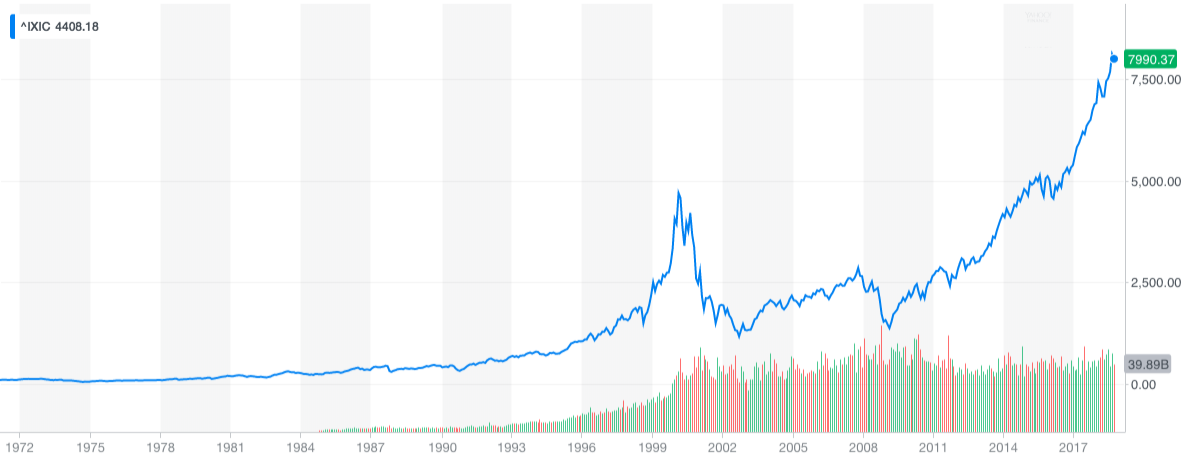

Started in 1957, the S&P 500 is a weighted average of the top 500 stocks in the US by market cap. Unlike the price weight of the Dow the S&P 500 is cap weighted meaning that companies with a larger market capitalization represent a larger portion of the index. For example, a price swing in Amazon would have a bigger effect on the index than a price swing in Campbell’s Soup. The NASDAQ composite is a composite index of all stocks trading on the NASDAQ exchange. If you haven’t heard of the NASDAQ exchange it’s simply a separate stock exchange from the NYSE set up in the 1970s as the first electronic exchange. To put this in simple terms every trade on the NYSE gets cleared in New York at the NYSE. The NASDAQ is different as it allows sellers to automatically connect to buyers in a decentralized manner. For further details click

The NASDAQ composite is a composite index of all stocks trading on the NASDAQ exchange. If you haven’t heard of the NASDAQ exchange it’s simply a separate stock exchange from the NYSE set up in the 1970s as the first electronic exchange. To put this in simple terms every trade on the NYSE gets cleared in New York at the NYSE. The NASDAQ is different as it allows sellers to automatically connect to buyers in a decentralized manner. For further details click