The United States economy has been on a hot streak. Overall growth had been present for years and recent corporate tax cuts put gasoline on the economic flames. Precisely why talk of Federal Reserve interest rate hikes have been littering the news lately. Today I want to discuss what that actually means for the economy and for you as an individual.

So what does the Fed actually do?

At a very high level the Federal Reserve has been enacted by Congress to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates.” This has come to be known as the “dual mandate.” Why there is three mandates in the dual mandate I do not know, but I don’t make the rules.

It is important to note that maximum employment is not necessarily 100% employment. In theory it should be, but in reality you will always have people leaving jobs or in the process of switching jobs for many uncontrollable reasons. However, since we currently sit at some of the lowest unemployment levels in history I’m not so sure the Fed is as concerned with people being able to find work as they are with the other two things in the dual (triple) mandate.

Right now Jerome Powell and the Federal Reserve are working overtime to figure out how to keep inflation within controllable levels as the economy heats up. In other words, as more money is accumulated to pay for goods and services they are trying to prevent that $3 Starbucks coffee you shouldn’t be getting every morning from becoming a $4 Starbucks coffee you shouldn’t be getting every morning.

Where interest rates come in

Raising or lowering interest rates is one of the most common tools the Fed uses to keep prices stable. If they feel the economy is heating up and inflation is rising they may choose to raise interest rates to discourage borrowing, something that goes hand in hand with economic growth, and vice versa.

When the Fed alters rates they are referring to the federal funds rate or the rate at which banking institutions can lend money overnight to other banking institutions. This may not affect individuals directly, but over the long term interest rates offered by banks change accordingly. This eventually ripples out into the entire economy with the hope of controlling growth or jump starting the economy when it slows or contracts.

The Federal Reserve’s Federal Open Market Committee(FOMC) meets 8 times a year to discuss rates usually about 7 weeks apart. This ties into the moderate long term interest rates portion of the dual, but actually triple mandate. Quite obviously, an extreme change in the rate can have unforeseen effects on the economy so the Fed elects to raise or reduces rate gradually over time. The Fed can also elect to keep rates unchanged if they believe inflation is where they would like it to be. Currently the target rate of inflation is 2%.

While robust economic growth is good for everyone as it means more jobs, higher pay, and rising markets it is important that it is contained. Additionally, it is important to encourage borrowing by lowering rates when times are not so good. A stable economy that tends to expand over time is best for everyone as it keeps the maximum amount of people employed and will not radically change the price of goods. The Federal Funds Rate is a tool to keep the economy on the right track.

Some more links for you:

Federal Reserve website FAQ section

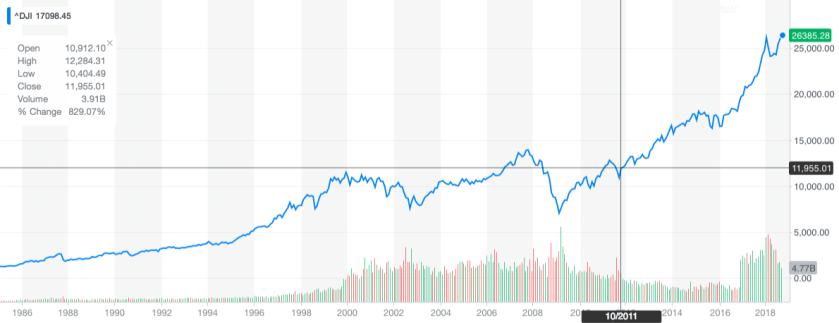

The Dow traces its roots back to 1885 and was officially introduced in 1896 when Charles Dow calculated an average of 12 purely industrial stocks. Surprisingly, it is not the oldest index as it is 12 years younger than the Dow Transportation Average. It has come a long way since then and now holds 30 stocks with none of the original 12 remaining. GE has the record for the longest Dow membership, but was recently removed for Walgreens amidst a series of financial blunders. The companies are selected by a committee of experts with the goal being to select companies that together best represent the US economy as a whole rather than purely industrials for which it was originally intended.

The Dow traces its roots back to 1885 and was officially introduced in 1896 when Charles Dow calculated an average of 12 purely industrial stocks. Surprisingly, it is not the oldest index as it is 12 years younger than the Dow Transportation Average. It has come a long way since then and now holds 30 stocks with none of the original 12 remaining. GE has the record for the longest Dow membership, but was recently removed for Walgreens amidst a series of financial blunders. The companies are selected by a committee of experts with the goal being to select companies that together best represent the US economy as a whole rather than purely industrials for which it was originally intended. Started in 1957, the S&P 500 is a weighted average of the top 500 stocks in the US by market cap. Unlike the price weight of the Dow the S&P 500 is cap weighted meaning that companies with a larger market capitalization represent a larger portion of the index. For example, a price swing in Amazon would have a bigger effect on the index than a price swing in Campbell’s Soup.

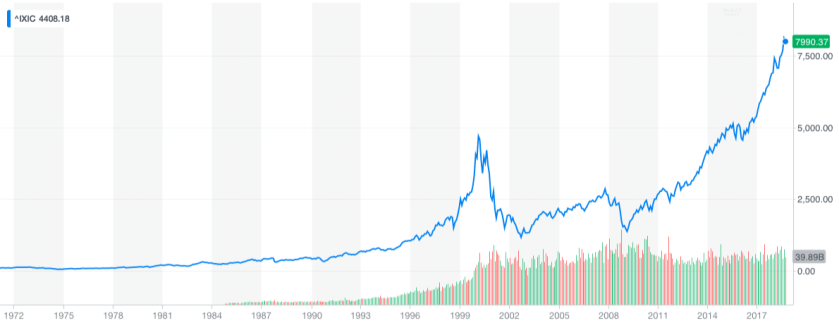

Started in 1957, the S&P 500 is a weighted average of the top 500 stocks in the US by market cap. Unlike the price weight of the Dow the S&P 500 is cap weighted meaning that companies with a larger market capitalization represent a larger portion of the index. For example, a price swing in Amazon would have a bigger effect on the index than a price swing in Campbell’s Soup. The NASDAQ composite is a composite index of all stocks trading on the NASDAQ exchange. If you haven’t heard of the NASDAQ exchange it’s simply a separate stock exchange from the NYSE set up in the 1970s as the first electronic exchange. To put this in simple terms every trade on the NYSE gets cleared in New York at the NYSE. The NASDAQ is different as it allows sellers to automatically connect to buyers in a decentralized manner. For further details click

The NASDAQ composite is a composite index of all stocks trading on the NASDAQ exchange. If you haven’t heard of the NASDAQ exchange it’s simply a separate stock exchange from the NYSE set up in the 1970s as the first electronic exchange. To put this in simple terms every trade on the NYSE gets cleared in New York at the NYSE. The NASDAQ is different as it allows sellers to automatically connect to buyers in a decentralized manner. For further details click